Trading fees on Robinhood are important to consider. No matter if you are new or experienced, choosing a low-fee brokerage can help you save money and earn more. Robinhood is popular for its commission-free trades, but does it have hidden costs? In this post, we will explain trading fees on Robinhood, compare them with other low-fee brokerages, discuss Robinhood’s day trading rules, and show you how to get free stocks on Robinhood.

Table of Contents

- Introduction

- Trading Fees on Robinhood

- Is Robinhood Really Free?

- Comparison of Low-Fee Brokerages

- Which Brokerage Has the Lowest Fees?

- Robinhood Day Trading Rules

- How to Avoid Day Trading Restrictions on Robinhood

- How to Get Free Robinhood Stocks

- List of FINRA Member Firms

- Wrapping Up

- FAQs

Trading Fees on Robinhood

Robinhood is famous for offering zero-commission trading on stocks, ETFs, and options. This means you don’t have to pay a fee every time you buy or sell these assets. However, some fees still apply.

- Regulatory Fees: These are small fees required by the government. For example:

-

- The SEC (Securities and Exchange Commission) fee applies when selling stocks. It is about $8.00 for every $1,000,000 in sales (a tiny fraction of a penny per share).

- The FINRA Trading Activity Fee (TAF) is $0.000145 per share, with a maximum of $7.27 per trade.

- Margin Trading Fees: If you use Robinhood Gold, which allows you to borrow money for trading, you will pay a $5 monthly subscription fee and an interest rate on borrowed funds (currently 8%–12%, depending on market conditions).

- Options Contract Fees: Although Robinhood doesn’t charge for options trading, there are regulatory fees from the OCC (Options Clearing Corporation) and other regulatory bodies.

- Crypto Trading Fees: Robinhood does not charge direct commissions on crypto, but it earns from spread fees, meaning you pay slightly more when buying or receive slightly less when selling.

Is Robinhood Really Free?

For most stock traders, yes, Robinhood is nearly free. However, if you’re trading large amounts, borrowing money (margin), or dealing with crypto, you might still face some costs.

Not everyone prefers Robinhood. Many brokerage firms with lowest fees also offer low-cost trading. Here are some of the best ones:

- Fidelity

- Stock & ETF Trades: $0 commission

- Options Contracts: $0.65 per contract

- Mutual Funds: Some are free, others charge fees

- Margin Rates: 8.25%–12.25% (varies by amount borrowed)

- Best for: Long-term investors, retirement accounts

- Charles Schwab

- Stock & ETF Trades: $0 commission

- Options Contracts: $0.65 per contract

- Mutual Funds: Some free, others charge

- Margin Rates: 8.25%–12.325%

- Best for: Investors who want full-service features

- E*TRADE

- Stock & ETF Trades: $0 commission

- Options Contracts: $0.65 per contract (discounted to $0.50 if trading 30+ contracts per quarter)

- Margin Rates: 8.95%–13.70%

- Best for: Active traders

- Webull

- Stock & ETF Trades: $0 commission

- Options Contracts: $0 commission

- Crypto Trading: Small spread fees

- Margin Rates: 9.49%–5.49%

- Best for: Active traders who want free options trading

- TD Ameritrade (Now part of Charles Schwab)

- Stock & ETF Trades: $0 commission

- Options Contracts: $0.65 per contract

- Margin Rates: 11.25%–13.75%

- Best for: Beginners and long-term investors

- Interactive Brokers (IBKR)

- Stock & ETF Trades: $0 commission (for IBKR Lite)

- Options Contracts: $0.65 per contract

- Margin Rates: As low as 5.83%

- Best for: Professional and international traders

Which Brokerage Has the Lowest Fees?

If you are looking for a brokerage with the lowest fees, Robinhood, Webull, and Fidelity are great choices. Webull and Robinhood are ideal for free options trading, while Fidelity is better for long-term investors.

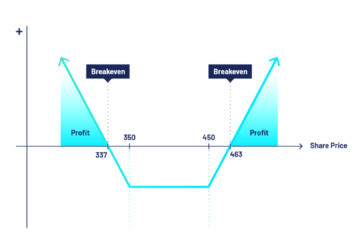

Robinhood day trading means buying and selling the same stock within the same day. However, Robinhood has strict rules if you want to day trade frequently.

If you make more than 3 day trades within a 5-day period and have less than $25,000 in your account, Robinhood will mark you as a Pattern Day Trader (PDT). This means:

- Your account could be restricted for 90 days unless you deposit more money.

- You must have $25,000 or more to freely day trade.

How to Avoid Day Trading Restrictions on Robinhood

- Stay Under the 3-Day Trade Limit: If you don’t have $25,000, limit yourself to 3 day trades per 5-day period.

- Hold Stocks Overnight: If you buy a stock today and sell it tomorrow, it’s not considered a day trade.

- Use a Cash Account: A cash account doesn’t ha ve PDT restrictions, but you must wait for funds to settle before trading again.

How to Get Free Robinhood Stocks

Robinhood gives away free stocks when you refer friends or sign up as a new user. Contact on Robinhood Support Phone Number for Assistance

How to Claim Free Robinhood Stocks

- Sign Up on Robinhood: New users can get a free stock worth $3–$200.

- Refer Friends: When you invite friends, both of you get a free stock.

- Complete Promotions: Occasionally, Robinhood offers promotions where users can earn extra free stocks.

List of FINRA Member Firms

The Financial Industry Regulatory Authority (FINRA) oversees brokerage firms in the U.S. To legally operate, a brokerage must be a FINRA member.

Here are the list of FINRA member firms:

- Fidelity Investments

- Charles Schwab

- E*TRADE

- TD Ameritrade

- Robinhood Financial LLC

- Webull Financial LLC

- Interactive Brokers

Wrapping Up

If you are looking for a brokerage with the lowest fees, Robinhood is a great choice for commission-free trading. However, Fidelity, Webull, and E*TRADE also offer low-cost options. If you plan on day trading on Robinhood, make sure you follow the PDT rules to avoid restrictions.

And don’t forget, you can get free Robinhood stocks by signing up and referring friends.

FAQs

Does Robinhood charge any trading fees?

Robinhood offers commission-free trading on stocks, ETFs, and options. However, regulatory fees, margin interest, and crypto spread fees may apply.

What are the hidden costs of trading on Robinhood?

While trading stocks and options is commission-free, you may pay regulatory fees, margin interest if using Robinhood Gold, and small spread fees on crypto transactions.

Which brokerage firms have the lowest trading fees?

Some top brokerage firms with low fees include Robinhood, Webull, Fidelity, Charles Schwab, E*TRADE, TD Ameritrade, and Interactive Brokers.

How does Robinhood compare to other low-cost brokerages?

Robinhood offers commission-free trading, but other brokers like Fidelity and Webull also have $0 commissions. Some brokers charge small fees for options contracts and margin trading.

What is the SEC fee on Robinhood?

The SEC charges a small fee when selling stocks. It is about $8.00 per $1,000,000 in sales, which is a tiny fraction of a penny per share.