Understanding Limit and Stop Orders

Before jumping into the mechanics of placing these orders in NinjaTrader, let’s clarify their basic functions: how to do limit and stop in dom ninja trader

- Limit Order: A limit order is an order to buy or sell a security at a specific price or better. If the market price reaches your specified limit price. The order becomes a market order and is executed at the best available price.

- Stop Order: A stop order is an order to buy or sell a security once the price reaches a specified level. Once triggered, a stop order becomes a market order.

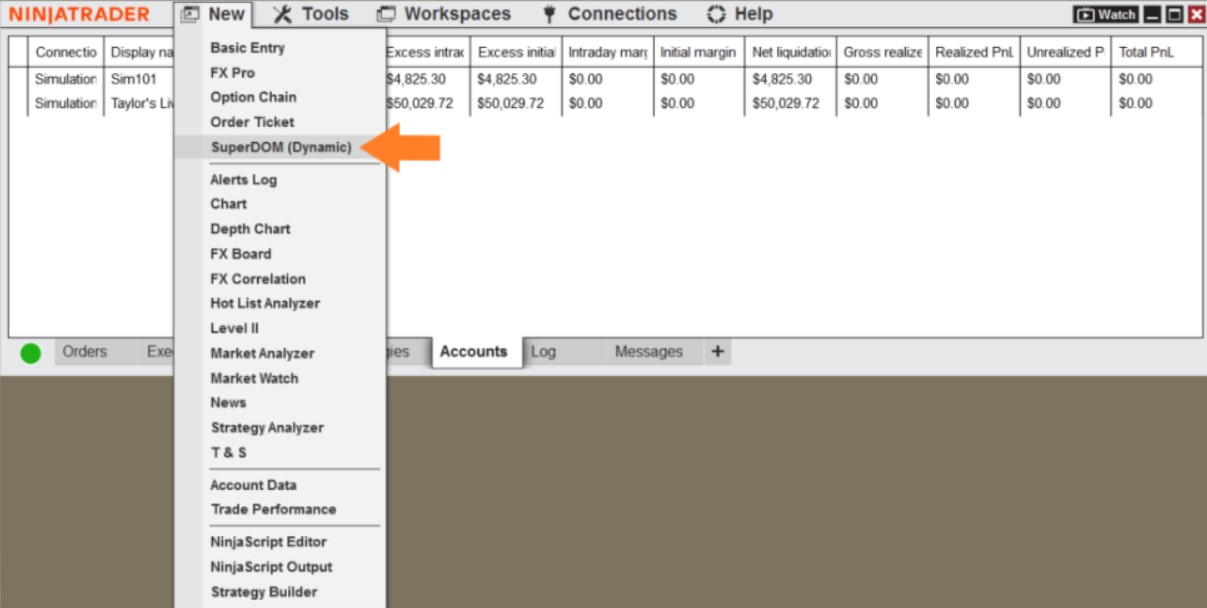

Placing Limit and Stop Orders in NinjaTrader’s DOM

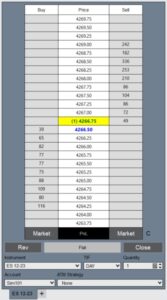

Placing limit and stop orders in NinjaTrader’s DOM allows traders to execute precise trades based on real-time market data. This feature provides a visual interface for monitoring order flow, making it easier to identify optimal entry and exit points and manage positions effectively.

Limit Orders

- Identify the desired price level: In the DOM, locate the price level where you want to place your limit order.

- Click the left mouse button: Click the left mouse button on the desired price level in the buy or sell column. This will create a limit order at that price.

- Adjust order quantity: You can typically adjust the order quantity by right-clicking on the order and selecting “Modify Order.”

Stop Orders

- Identify the stop price: Determine the price level at which you want your stop order to be triggered.

- Click the middle mouse button: Hold down the Ctrl key and click the middle mouse button (scroll wheel) on the desired price level in the buy or sell column. This will create a stop market order.

- Adjust order quantity: Similar to limit orders, you can modify the order quantity by right-clicking on the order.

Note: Some users prefer to set the middle mouse button to submit stop market orders by default. This can be done in the SuperDOM Properties.

Stop Limit Orders

A stop limit order combines elements of both stop and limit orders. It is triggered when the market reaches a specified stop price. But then executes as a limit order at a predefined limit price.

To place a stop limit order in NinjaTrader’s DOM:

- Click the middle mouse button on the desired stop price level in the buy or sell column.

- A dialog box will appear allowing you to input the limit price and order quantity.

Advanced Order Types and DOM Functionality

NinjaTrader offers additional order types and DOM features to enhance trading strategies:

- Trailing Stop Orders: These orders automatically adjust the stop price as the market moves in your favor, protecting profits.

- One-Cancels-the-Other (OCO) Orders: This order type allows you to link a limit order and a stop order. So that if one is executed, the other is canceled.

- Market-If-Touched (MIT) Orders: Similar to stop orders. But the order becomes a market order when the specified price is reached, rather than a stop order.

- DOM Customization: NinjaTrader allows you to customize the DOM’s appearance, including color schemes, data columns, and order entry shortcuts.

Combining Limit and Stop Orders with Technical Analysis

This approach helps traders optimize entry and exit points, manage risks, and improve profitability through informed decision-making. Here’s the things you need to follow:

- Support and Resistance Levels: Use the DOM to identify potential support and resistance levels based on order clustering.

- Trend Following: Combine limit and stop orders with trend-following indicators to capitalize on market momentum.

- Breakout Trading: Utilize limit orders to enter positions after a price breakout, with stop orders to protect profits.

- Mean Reversion: Employ limit orders to take advantage of price reversals, with stop orders to manage risk.

Tips for Using Limit and Stop Orders Effectively

- Understand market dynamics: The effectiveness of limit and stop orders depends on market conditions. Consider factors such as volatility, order flow, and market microstructure.

- Use order management tools: NinjaTrader provides tools for managing and monitoring orders, such as the Order Flow window and the Order Watch.

- Practice risk management: Limit and stop orders are essential components of risk management. Use them to protect your capital and define your profit targets.

- Test your strategies: Backtesting and paper trading can help you refine your order placement strategies and identify potential pitfalls.

- Consider alternative order types: Explore other order types available in NinjaTrader to find the best fit for your trading style.

The Bottom Line

Mastering the use of limit and stop orders in NinjaTrader’s DOM is a crucial skill for any trader. By understanding their functions and utilizing the platform’s features effectively, you can improve your order execution and risk management. Remember to practice and experiment with different order types to find the strategies that work best for you.