Effective Steps to Close a Charles Schwab Account

The following are the steps that can help you understand how to close a Charles Schwab account:

Step 1: Withdraw or Transfer Funds

The first step before closing any brokerage account is to ensure that all funds and assets are withdrawn or transferred. Leaving funds in the account when attempting to close it can cause delays. Schwab will not close the account until the balance is zero.

-

Transfer Funds to Your Bank Account Using ACH

The most straightforward way to transfer funds out of your Schwab account is to use Automated Clearing House (ACH) transfers.

- Log into your Schwab account through the website or mobile app.

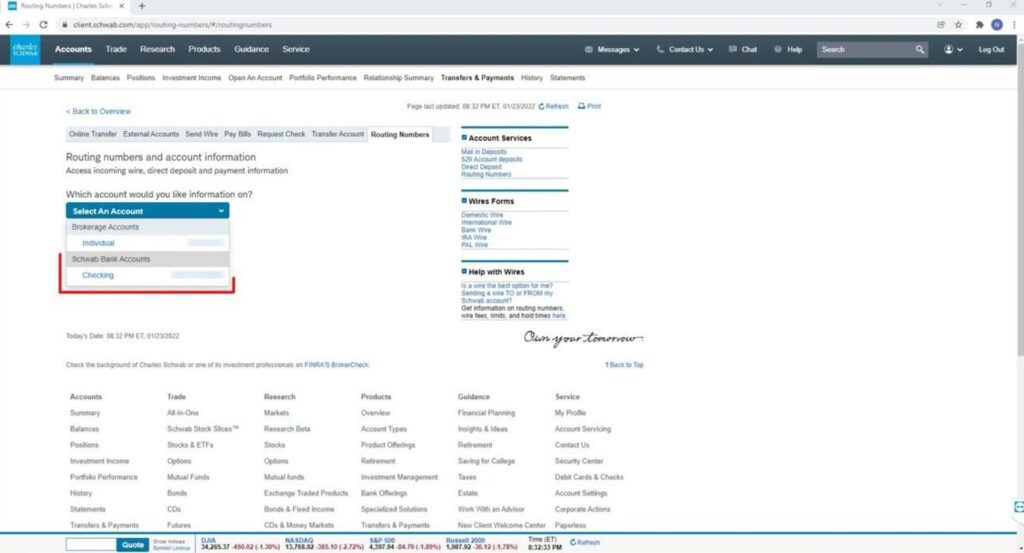

- Jump to the “Transfers & Payments” section.

- Select “ACH Transfer” to move funds directly to your bank account.

ACH transfers are generally free and can take one to two business days to complete. Ensure that the linked bank account is accurate to avoid transfer delays.

-

Transfer Investments to Another Brokerage Firm

If you have investments in your Schwab account, you can transfer them to another brokerage using ACATS without selling.

- Contact the new brokerage firm where you want to transfer your assets.

- Inform them that you would like to initiate a transfer from your Schwab account via ACATS.

- Follow their instructions and provide the necessary account information.

Using ACATS allows you to transfer your investments directly without triggering any tax consequences from selling the assets. The process can take between five to seven business days, depending on the assets and the firms involved. Ensure that the new brokerage accepts all the types of assets you plan to transfer.

-

Request a Check for the Balance

For those who prefer receiving a check, Charles Schwab allows you to request a check for any remaining balance in your account.

- Contact Schwab’s customer service to request a check.

- Confirm the mailing address where the check should be sent.

- Receiving a check may take longer than other transfer methods, but it’s a valid option for those who prefer paper transactions.

Step 2: Contact Charles Schwab Customer Service

Once you’ve withdrawn or transferred all funds and assets, the next step is to contact Schwab to close your account. Schwab offers several ways to close an account, making it convenient no matter your preference.

- By Phone

One of the most direct ways to close your account is by calling Charles Schwab’s customer service line. They provide 24/7 assistance, making it easy to reach them at any time.

- Call Schwab’s customer service.

- Inform the representative that you want to close your account.

The representative will guide you through the process and ensure that everything is in order for the closure. Make sure to have your account number and any relevant information ready.

- By Secure Messaging

If you prefer not to speak with someone on the phone, Schwab allows you to request account closure via secure messaging.

- Log into your Schwab account through their website or mobile app.

- Go to the “Messages” or “Contact Us” section.

- Send a secure message requesting the closure of your account.

In your message, include your account details and confirm that all funds have been withdrawn or transferred. The secure messaging option is a great alternative for those who prefer to handle everything online.

- In Person

If you prefer a face-to-face interaction, you can visit a local Charles Schwab branch to close your account in person.

- Use Schwab’s branch locator tool online to find the nearest branch.

- Bring a government-issued ID for verification purposes.

At the branch, a representative will assist you in closing your account. This option is particularly useful if you have any complex questions or need additional assistance during the process.

Step 3: Submit a Written Request (If Needed)

Most standard accounts can be closed via phone or messaging, but retirement or trust accounts may need a written request. This extra step ensures that all legal and regulatory requirements are met for more complex accounts. How to Find Your Charles Schwab Trading Account Number

- Contact Schwab’s customer service to confirm whether your account requires a written closure request.

- If needed, submit a written request via secure message, fax, or mail.

The written request should include your account number, a statement requesting closure, and your signature. If you’re mailing the request, make sure to use a reliable delivery method to ensure it reaches Schwab.

Step 4: Check for Outstanding Fees or Restrictions

Before closing your account, ensure there are no outstanding fees, restrictions, or pending transactions that might delay the process.

- Review your account to ensure that all pending transactions, open trades, or fees have been settled.

- If you owe any fees, Schwab will require you to pay them before closing the account.

- By addressing any outstanding issues beforehand, you can ensure a smooth and efficient closure.

Step 5: Account Closure Confirmation

Once the closure process is complete, Charles Schwab will send you a confirmation to verify that your account has been closed.

- Expect to receive this confirmation via email or traditional mail.

- Keep this confirmation for your records in case any issues arise later.

The confirmation is crucial, as it verifies Schwab has officially closed your account and you have no remaining obligations.

Final Words

If you follow the right steps for how to close a Charles Schwab account, the closing process is easy. Start by withdrawing or transferring funds, contact Schwab via phone, secure messaging, or in person. Make sure all outstanding fees and transactions are resolved. Remember, some accounts may require a written request, and it’s essential to close all linked accounts separately.