Options trading has many strategies to capitalize on market volatility, with the versatile long strangle. A long strangle lets traders profit from significant price movements, regardless of whether the asset moves up or down. It is especially attractive when a large price move is expected, but the direction is uncertain. In this blog, we will explore how to place a long strangle on Webull, covering steps. We will also discuss strategies for maximizing profit potential while minimizing risks when using the long strangle.

What is a Long Strangle?

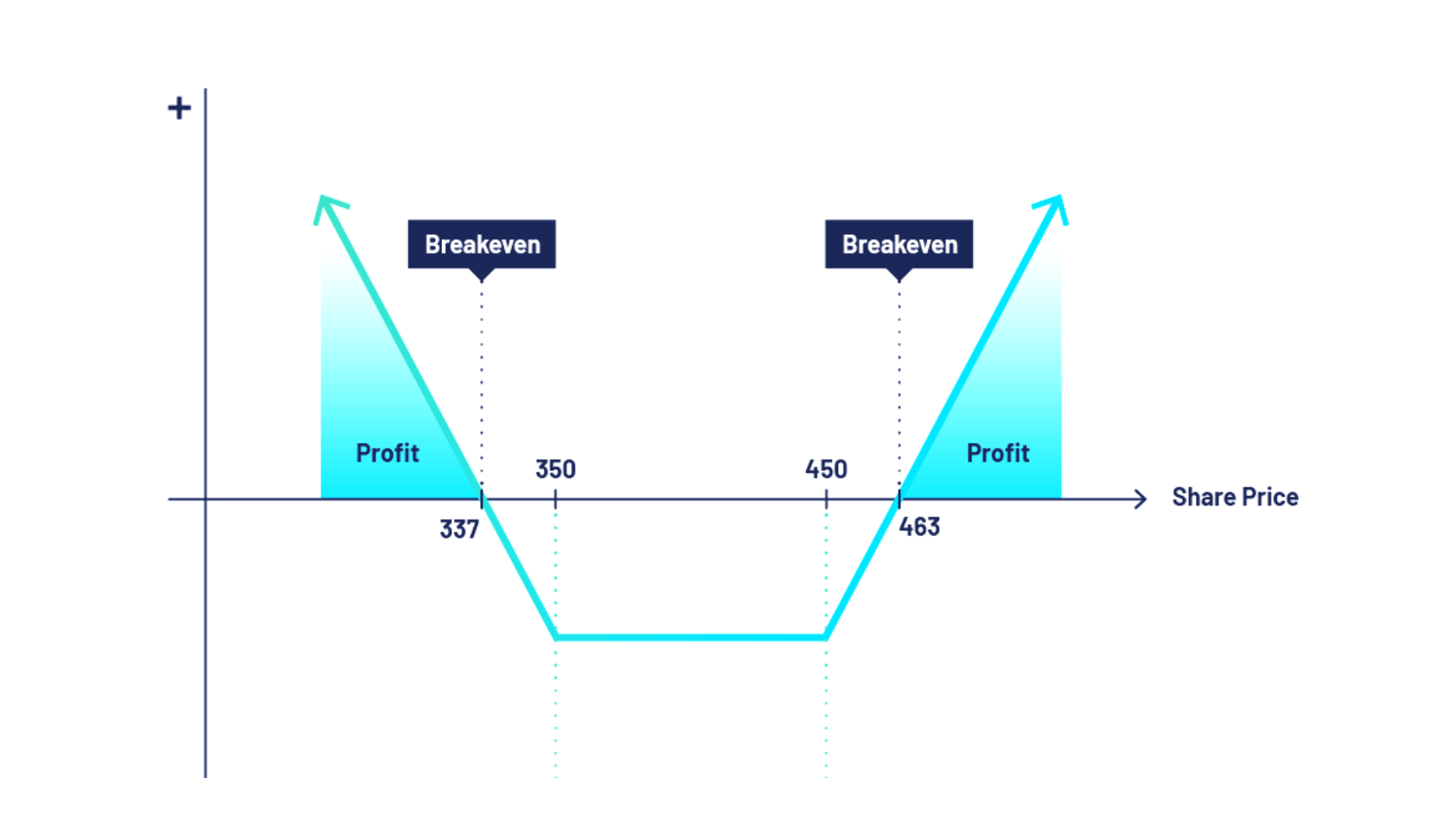

A long strangle is an options strategy involving buying both a call and put with the same expiration date. The call option is out-of-the-money (OTM), meaning its strike price is above the current asset price. The put option is also OTM, with its strike price below the current asset price. This strategy profits from significant price movements in either direction—up or down. If the asset moves significantly, one option could gain enough value to cover both options’ costs and possibly more.

Why Use a Long Strangle?

The long strangle strategy is ideal for traders who expect a significant price movement but aren’t certain about the direction. Whether the underlying asset rises dramatically or falls sharply, the trader can profit. This strategy is particularly useful during:

- Earnings reports: When a stock may experience a large price swing due to new information.

- Economic reports: That could cause market-wide volatility.

- Volatility spikes: When there is an expectation of a rapid movement in asset prices without a clear prediction of whether it will move up or down.

How to Place a Long Strangle on Webull

Now, let’s walk through how to place this trade on Webull. Webull is known for its intuitive interface and advanced trading features, making it a popular platform for options traders.Know More about Webull

Step 1: Open Webull and Go to the Options Trading Screen

- Log in to your Webull account: Start by accessing your Webull account either through the mobile app or desktop platform.

- Search for the ticker symbol: Use the search bar at the top of the platform to find the ticker symbol of the stock or ETF on which you want to place your options trade.

- Go to the Options tab: Click on the Options tab once on the stock’s main page. This will open the options chain, where you can view available call and put options for the stock.

Step 2: Select the Same Expiration Date

- Pick the expiration date: A key part of the long strangle strategy is selecting an expiration date for both the call and put options. Both options must have the same expiration date.

- Consider time to expiration: It’s important to select an expiration date that gives the stock enough time to make a significant move. Choosing an expiration date that’s too soon may limit the stock’s chance to reach breakeven or generate profit.

Step 3: Choose an Out-of-the-Money Call and Put

- Select the strike prices: For a long strangle, you want to buy both an out-of-the-money call option and an out-of-the-money put option. These will have different strike prices:

- Call option: Choose a call with a strike price that is higher than the current stock price.

- Put option: Choose a put with a strike price that is lower than the current stock price.

Out-of-the-money options lack intrinsic value at purchase but can become profitable with a significant stock price move.

Step 4: Add Both Options to Your Cart

- Buy the call option: Click on the Buy button next to the call option that you’ve selected.

- Buy the put option: Similarly, click on the Buy button next to the put option you wish to buy.

Both options should now appear in your options order cart, where you’ll be able to review them before placing your trade.

Step 5: Customize Your Order

Webull gives traders the flexibility to adjust their orders to meet their specific needs.

- Set the quantity: Adjust the number of contracts you wish to trade. Remember, each contract represents 100 shares of the underlying stock.

- Limit vs. Market orders: You can choose between a limit order (where you specify the maximum price you’re willing to pay) or a market order (which executes at the current market price).

- Review the total premium: The total premium is the amount you’ll pay for both options. This is your maximum risk in a long strangle since you cannot lose more than the total premium paid for the two options.

Step 6: Confirm and Execute the Trade

- Review the trade details: Ensure that all the details are correct—specifically that you are buying both a call and a put option with the right strike prices and the same expiration date.

- Place the order: When you’re satisfied with the order, click Place Order to execute the trade.

Step 7: Monitor Your Position

- Track the underlying asset’s price: After your trade is executed, you can monitor your options positions under the Positions tab in the Webull app or platform.

- Watch time decay: Time decay (also known as theta) works against you in this strategy. As the expiration date nears, the options lose value if the stock price remains stagnant.

- Profit from volatility: The strangle strategy thrives on large price movements, so keep a close eye on the underlying asset’s price movement. Ideally, the price should breach one of the breakeven points for the strategy to be profitable.

The Bottom Line

A long strangle is an advanced options strategy that profits from large price swings in either direction. On Webull, placing a long strangle involves buying both an out-of-the-money call and put with the same expiration date. This strategy is ideal when you expect a significant stock price move but are unsure of the direction. How to Use Ticks Charts on Webull

When placing a long strangle on Webull, consider factors like time decay, implied volatility, and breakeven points. By selecting options carefully and managing positions well, you can profit from volatility while keeping risks controlled.